Discover how organisations’ are reacting to the changing regulatory landscape and factors influencing their retirement strategy as employers’ try to balance financial viability with the retirement needs of employees.

Health and Benefits|RetirementRegulatory changes and labour reforms are likely to keep employers highly engaged in managing employee benefits. Containing cost, managing risk, and ensuring sustainability and compliance will be top priorities for employers.

WTW recently conducted the annual State of Retirement Benefits in India Survey to understand the issues that influence employers’ retirement strategy, how they manage these benefits, and how the market is reacting to various regulatory changes, as employers try to balance financial viability with the retirement needs of employees.

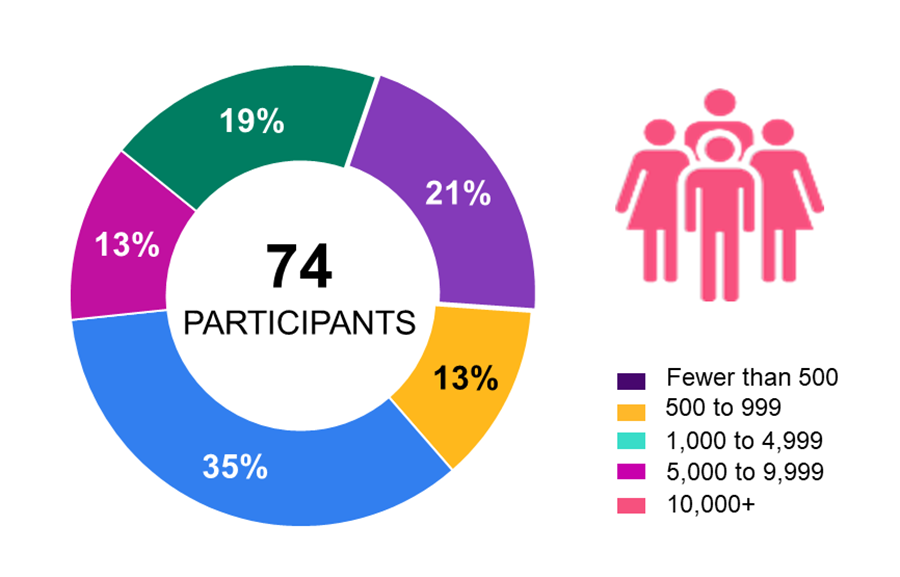

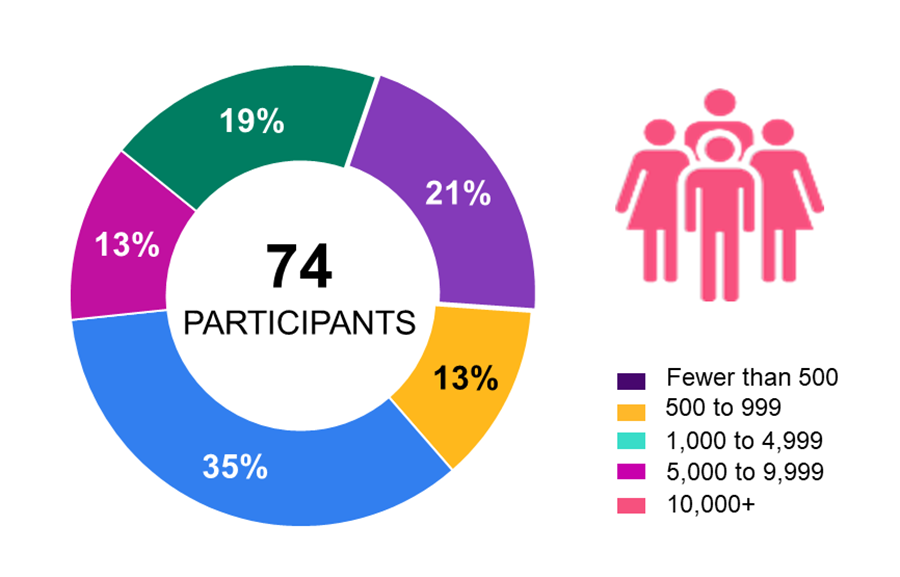

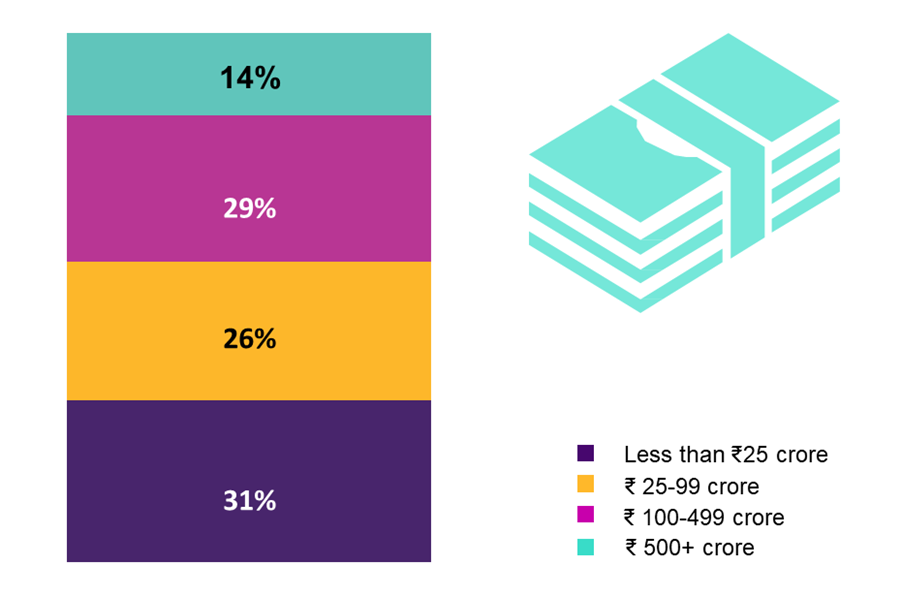

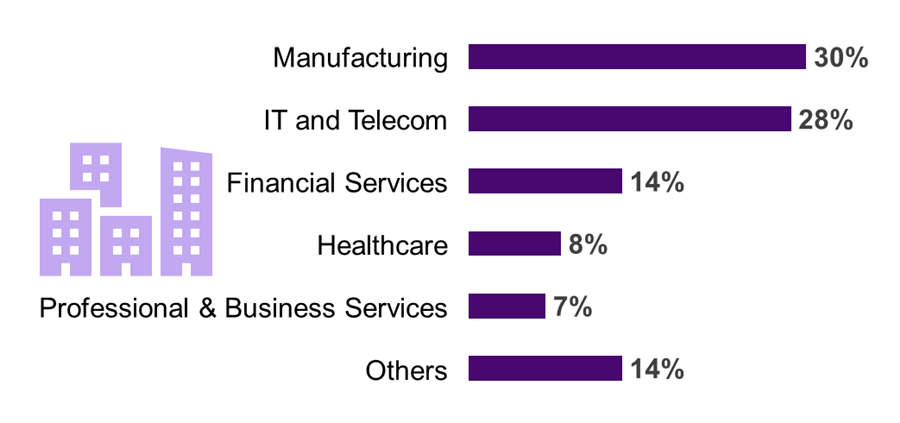

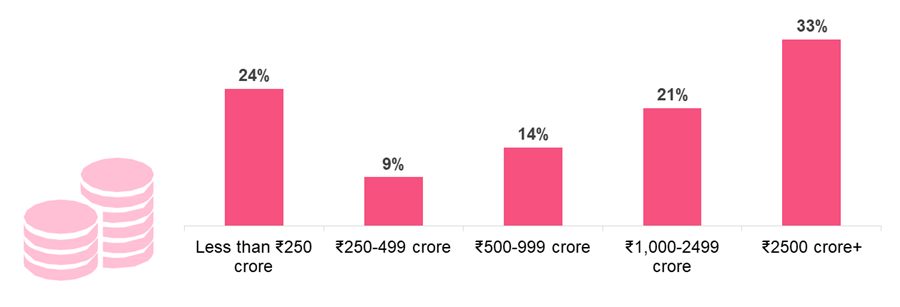

The State of Retirement Benefits in India Survey was run between December 2021 and February 2022 and covers responses from 74 employers from India.

Retirement benefits strategy

Employee experience/ complaints, regulatory complexity and harmonisation of benefits across business units were rated as the top 3 issues impacting an organisation’s retirement benefits strategy

Need guidance around how to approach retirement plan design for your organisation?

64% of companies in India expect labour code change to have significant impact on P&L, WTW study finds

Employees’ Provident Fund (EPF)

Half the respondents who sponsor an exempt PF Trust acknowledged that managing their own PF trust is not a sustainable option in the long-term

National Pension System (NPS)

NPS prevalence has increased with 60% respondents now offering the Corporate model to their employees and another 24% are planning or considering its provision; however, participation rates continue to be low

Over 70% respondents have taken action to assess the potential impact of the Labour Codes, with a majority expecting a significant impact on P/L

Please complete the form to receive the executive summary. For more information, write to us.